Kudi AI

Designing a chatbot for financial services in Nigeria

Year

2016

Role

Founding designer

Platform

Web, facebook app

Team

Founders, engineers, data scientists, designer

Work done

Ran research, designed interactions, wrote copies, and worked with data scientists and engineers to map out flows of user experience from conception till launch. Refined the product for a year afterwards.

Context

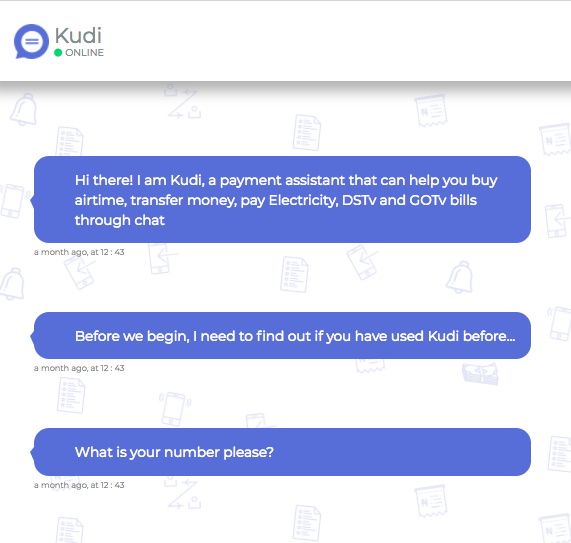

Kudi means "Money" in Hausa. Kudi bot was one of the products offered by Kudi Inc (YC '17), a fintech company in Lagos, Nigeria. The challenge of this project was to design a financial service, where people can transfer money through chat, buy airtime vouchers and pay their bills. It is the first of its kind in Nigeria - to offer financial service via a chatbot and existing chat platforms such as Facebook.

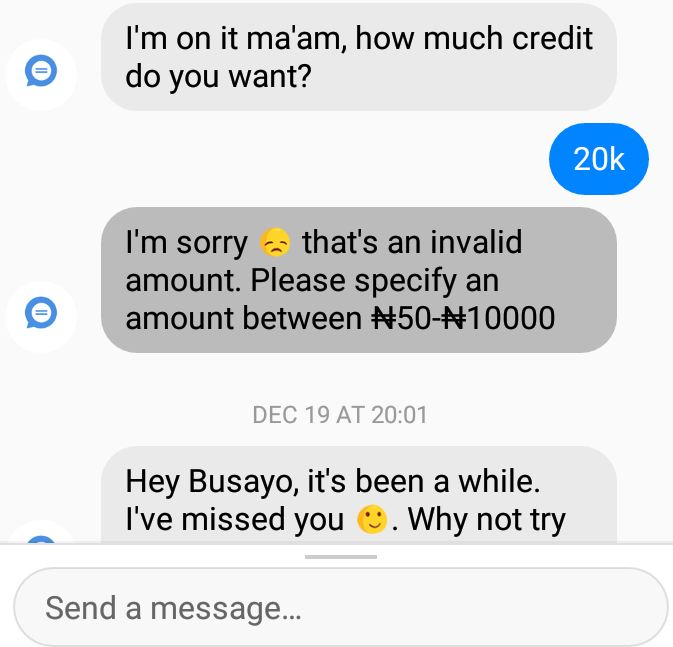

Early stage testing on Facebook messenger

Process

- Contextual inquiry - how do people use and talk about banking activities in real life?

- Flow charts of banking scenarios - Onboarding, bank transfers, bill payments etc.

- Designing bot persona & tone of voice - Friendly, trustworthy, efficient

- Designing limitations - Friendly, but not too friendly. Smart, but only in finance.

- UX writing - writing ux copies to simulate bot persona and tone

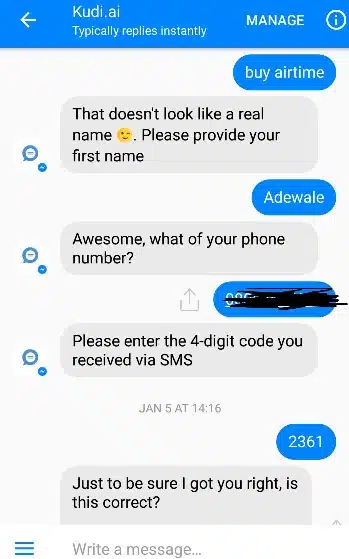

- Guerilla testing - test with closed group of early adopters on facebook messenger

- Iteration based on user feedback

Onboarding flow

Key Insights

- The trust issue - users were hesitant to add their credit cards to make payments. This required a lot of trust and education. Newspaper publications, and the company getting accepted into YC helped in this regard.

- There were more idle chat from users who were hesitant - the bot itself had to learn to reassure users, and redirect back to objectives.

- People use slangs when talking about money - 50 bucks, K, etc, we had to train the bot on all these slangs.

- Once people got the hang of the chatbot, they didn't type in full sentences. Short sentences that expressed their goals were used.

First time visit on the web platform

Outcome

- Kudi went on to be used by millions of users in Nigeria for their bank payments

- The company later rebranded and repositioned to Nomba

- Web Kudi AI can still be found here: chat.kudi.ai