Kudi Bot

Designing a chatbot for financial services

June 2016, UX designer and writer's log:

Kudi bot is one of the products offered by Kudi Inc (YC '17). Kudi Inc is a fintech company in Lagos, Nigeria.

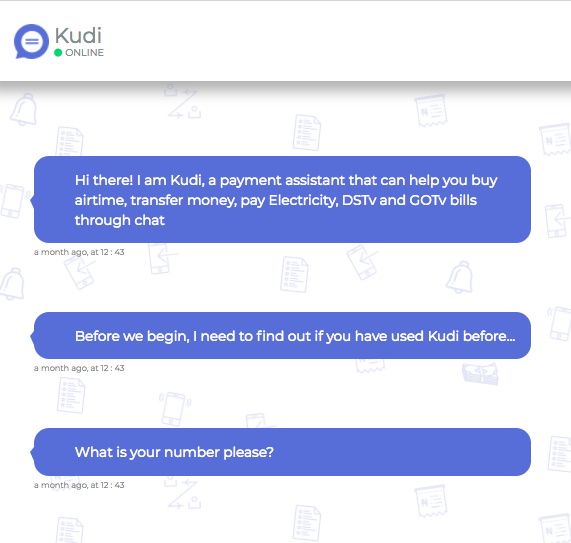

The challenge of this project is to design a financial service, where people can transfer money through chat, buy airtime vouchers and pay their bills. It is the first of its kind in Nigeria - to offer financial service via a chatbot.

The target audience for this product are Nigerians between the ages of 16 - 45, who are conversant with apps such as whatsapp and own a bank account.

For a delicate industry such as finance service, experimenting with a budding technology like natural language processing, artificial intellgence and chatbot results in a number of constraints that ranges from technology to security concerns. How these constraints are met and tackled are further discussed in the process below.

To design this solution, I went through a series of steps to get the job done:

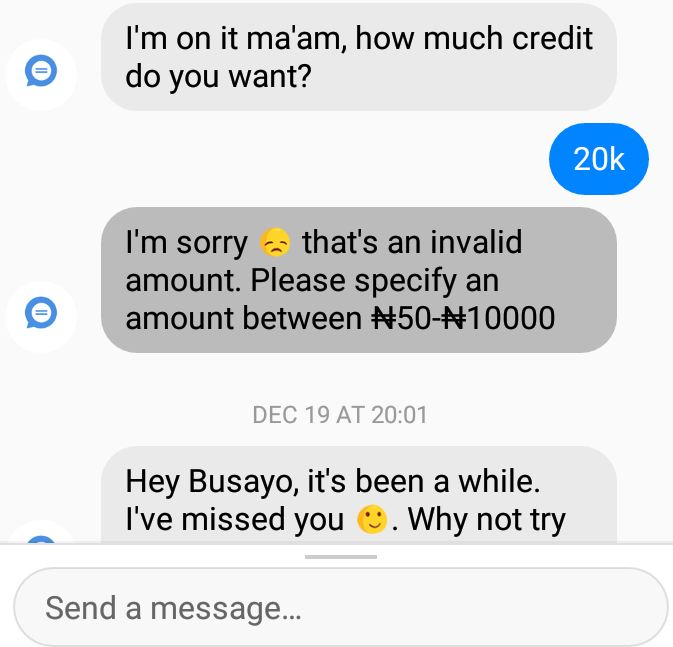

A major insight gained during one of our testing is the realisation that users were hesitant to add their card or account details at the beginning of their interaction with the bot. We had assumed that that should be the way the onboarding process should be, but this only resulted in drop-off. Users wanted to get to know the bot before they could commit. So we iterated to allow users to have as much small talk with the bot as they want and they onld added their card or account details when they were ready to perform a transaction.

Kudi bot is still being used by thousands of people daily to perform transactions. The bot was deployed on many messaging apps such as Telegram, Facebook, Skype, Slack, it also has a dedicated app of its own.

Next Project

Vendors.so